The latest epilepsy news

Who is 2026 Miss GB Surrey contestant Emma Dearling?

Emily Stanley | With Epilepsy Action supporter Emma Dearling beginning a new venture as a contestant on Miss GB Surrey, we share six amazing facts…

The latest epilepsy news

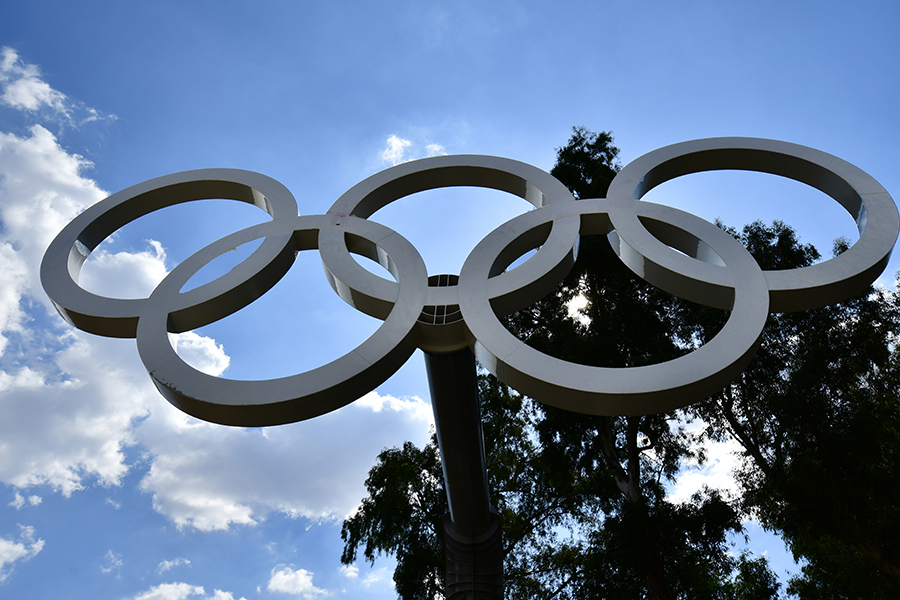

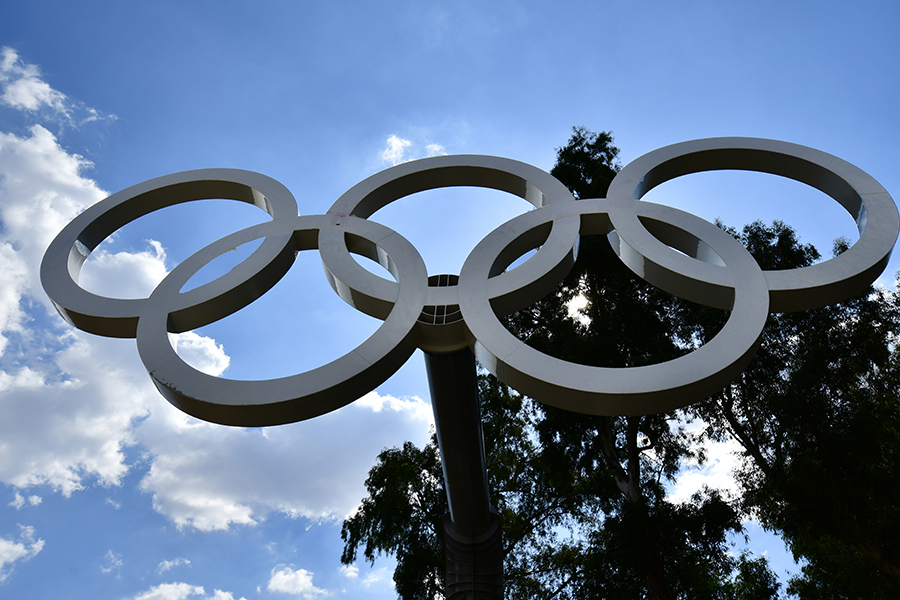

Seven athletes with epilepsy and their stories

Kami Kountcheva | In celebration of the Winter Olympics coming to a close, we spotlight seven athletes with epilepsy and their epilepsy journeys

The latest epilepsy news

PIP assessments leaving claimants with “anxiety” and assessors quitting

Kami Kountcheva | The PIP assessment process is leaving people with epilepsy with “anxiety” and assessors feeling “despised”, while charities urge that the Timms review…

The latest epilepsy news

MedicAlert and Epilepsy Action renew partnership to support people living with epilepsy

Epilepsy Action and MedicAlert renew partnership to help bring peace of mind in an emergency to more people with epilepsy

The latest epilepsy news

Valproate scandal compensation: Wes Streeting commits to respond to Hughes Report before next election

Kami Kountcheva | The Health Secretary has said he will respond to recommendations in the Hughes Report into the valproate scandal before the next general…

The latest epilepsy news

Epilepsy on EastEnders: Is Nugget having seizures?

Kami Kountcheva | EastEnders is the latest soap to feature an epilepsy storyline, exploring different types of seizures and their impact on driving

Features

Known risks, no redress: Families still left behind after valproate scandal

Lisa Greer | On the second anniversary of the Hughes report on the valproate scandal, Lorraine’s family, like countless others, is still waiting for essential…

The latest epilepsy news

After the Flood: Epilepsy in hit ITV drama

Kami Kountcheva | After the Flood season two’s central investigation features a character with epilepsy, whose condition is key in unravelling the case. (Beware of…

Purple Day

Fundraise your way and join the Purple Day community

Kami Kountcheva | With Purple Day only weeks away, it’s the perfect time to get inspired by the Purple Day fundraising community and plan your…